America is drowning in $34 trillion of national debt, running a $2 trillion annual deficit, and crushing businesses and workers with an outdated, oppressive tax system. This plan abolishes the IRS, replaces all federal taxes with a FairTax, unleashes energy dominance, leverages DOGE savings, and restructures trade policy to end the deficit and generate a $1 trillion surplus within 10 years.

Executive Summary

This proposal outlines a comprehensive economic overhaul to eliminate the $2 trillion annual deficit by implementing the FairTax, expanding natural gas and fracking, leveraging DOGE savings, monetizing assets such as gold cards, and reforming trade tariffs. Additionally, this plan includes a 20% rebate to taxpayers to offset short-term tariff costs and ensure a smooth transition.

By abolishing all federal taxes (income tax, payroll tax, corporate tax, estate tax, capital gains tax, and federal property taxes) and replacing them with a FairTax system, the U.S. can increase economic growth, bring back manufacturing, and remove IRS bureaucracy. Combined with energy independence and strategic asset sales, this plan ensures debt reduction and financial sovereignty.

I. Replacing the Federal Tax System with the FairTax

The FairTax Model (23% National Sales Tax)

- Replaces all federal taxes with a flat 23% sales tax on new goods and services.

- Eliminates income tax, corporate tax, payroll tax, capital gains tax, estate tax, and federal property taxes.

- Includes a prebate system to protect low-income earners.

- Abolishes the IRS, saving $12 billion annually in enforcement costs.

- Increases wages and productivity by allowing Americans to take home 100% of their paycheck.

Revenue Projections Under FairTax

- Current taxable personal consumption: $20 trillion.

- Estimated FairTax revenue at 23%: $4.6 trillion annually.

- Covers federal spending without punitive taxation on income, investment, or inheritance.

II. Eliminating the $2 Trillion Deficit: Energy, DOGE, and Gold Cards

A. Energy Reform: Unleashing Natural Gas & Fracking

- Expanding fracking & natural gas production could generate $500 billion+ in annual GDP growth.

- Exports of LNG (Liquefied Natural Gas) could bring in $300 billion in trade surpluses.

- Redirecting energy jobs back to the U.S. reduces unemployment and strengthens domestic supply chains.

B. DOGE Savings and Treasury Reserves

- Establish a DOGE Treasury Reserve Fund, leveraging crypto wealth to back infrastructure projects.

- Target $500 billion in DOGE-related investment savings over five years.

- Issue 20% of DOGE savings as rebates to taxpayers, offsetting the cost of short-term tariff adjustments.

C. Monetizing U.S. Gold Reserves with Gold Cards

- The U.S. holds 261 million ounces of gold (~$14 trillion).

- Selling 2 million “Gold Citizenship Cards” at $5 million each = $10 trillion in revenue.

- Buyers receive lifetime tax exemption and exclusive trade privileges.

- This eliminates the national debt while boosting U.S. economic credibility.

III. Manufacturing, Tariffs, and Reciprocal Trade Policy

A. Tariffs and Fair Trade Agreements

- Implement reciprocal tariffs to counter trade imbalances (projected revenue: $500 billion+ annually).

- Incentivize domestic production by reducing overseas dependency on China and other nations.

- Strengthen “America First” supply chains by prioritizing Made in USA industries.

B. Revitalizing American Manufacturing

- Cutting corporate taxes (via FairTax) encourages businesses to return to U.S. soil.

- Deregulation of energy, industry, and labor markets increases domestic production.

- Estimated manufacturing job growth: 5-10 million new jobs.

- Higher wages and increased exports boost GDP by $1 trillion annually.

IV. Offset Strategy: 20% DOGE Savings Rebate to Taxpayers

Immediate Consumer Relief

- To counter initial tariff-related inflation, 20% of DOGE savings (~$100 billion) is issued as direct rebates.

- Every American household receives a quarterly rebate check for the first 5 years post-reform.

Long-Term Gains

- As manufacturing strengthens and tariffs stabilize, consumer prices adjust downward.

- With no income tax, the average family saves 30-40% more annually.

- Higher domestic wages and job creation result in sustained economic expansion.

America’s Path to Financial Freedom

By implementing the FairTax, unleashing energy independence, leveraging DOGE savings, monetizing gold reserves, and revamping tariff structures, we can eliminate the deficit, restore fiscal sovereignty, and unleash a new era of economic prosperity.

This plan makes America the #1 tax haven, #1 energy producer, and #1 manufacturing powerhouse—without compromising personal freedom or economic opportunity.

This is the pro-growth, pro-America solution to financial independence.

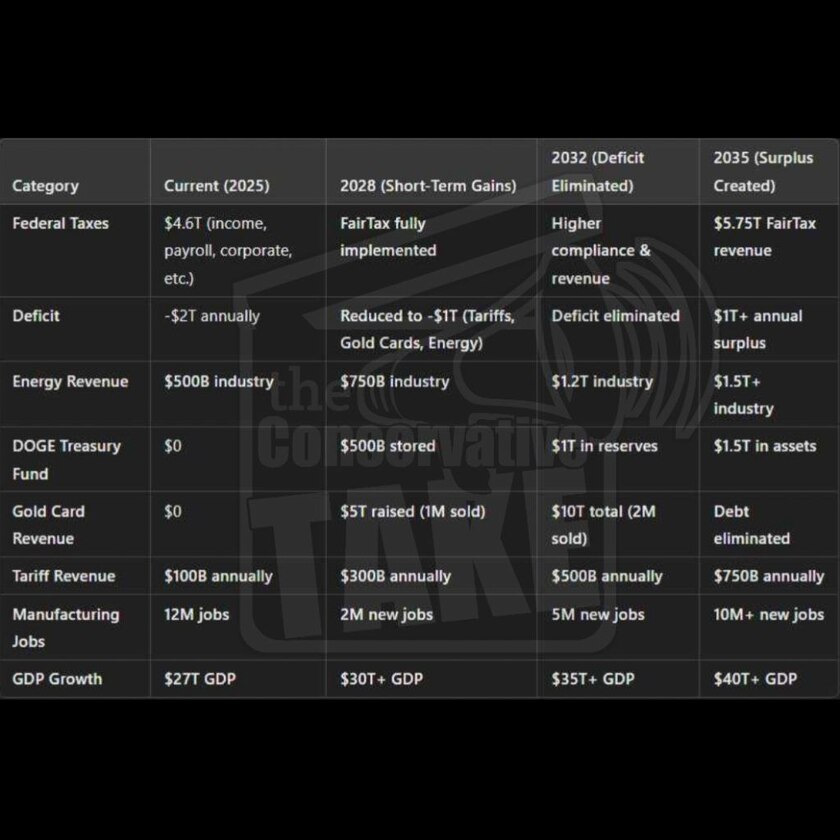

Economic Transition Plan: From 2025 to 2035

Below is a timeline and financial projection for implementing the FairTax, energy reform, DOGE savings, and tariff policies to eliminate the deficit and restore economic dominance.

The 10-Year Economic Projection: From Crisis to Surplus

Key Takeaways

✅ By 2028, the deficit is cut in half through energy expansion, tariffs, and gold cards.

✅ By 2032, the deficit is eliminated, the national debt is zero, and U.S. GDP surpasses $35T.

✅ By 2035, the U.S. runs a $1T+ surplus, leading in manufacturing, energy, and trade.

✅ No income tax, no corporate tax, no payroll tax—just a FairTax that fuels economic growth.

What do you think? Should Congress get behind this?

Bibliography

- "FairTax"

Wikipedia Contributors. An overview of the FairTax proposal, detailing its structure, intended effects, and legislative history.

en.wikipedia.org - "Predicted Effects of the FairTax"

Wikipedia Contributors. Analysis of the anticipated economic and social impacts of implementing the FairTax system in the United States. - "Revenue Neutrality of the FairTax"

Wikipedia Contributors. Discussion on whether the FairTax would generate sufficient revenue to match current federal tax receipts, considering various economic models and assumptions. - "Elon Musk asks if the IRS should be 'deleted' after agency begs for $20 billion"

Lee Brown. Coverage of Elon Musk's social media poll questioning the necessity of the IRS following its request for additional funding. - "Elon Musk calls to 'delete' US consumer finance watchdog"

Kari Paul. Report on Musk's criticism of the Consumer Financial Protection Bureau and his broader agenda to streamline federal agencies.

theguardian.com - "Why Is Elon Musk So Hell-Bent on Bulldozing the Government?"

Nick Bilton. Insight into Musk's role in the Department of Government Efficiency and his efforts to reduce federal bureaucracy.

vanityfair.com - "DOGE Staffer Arrives at Internal Revenue Service Headquarters"

Richard Rubin. Account of a Department of Government Efficiency aide's visit to the IRS, signaling potential reforms.

wsj.com - "Rand Paul pitches Elon Musk on plan to slash spending"

Hans Nichols. Details of Senator Rand Paul's proposal to Elon Musk regarding significant federal spending cuts.

axios.com - "Commentary: Looking for waste? IRS should be the target"

William Henck. Opinion piece highlighting inefficiencies within the IRS and advocating for targeted reforms.

myjournalcourier.com - "Millions of Californians could be eligible for DOGE stimulus checks - but will they really happen?"

Kathleen Pender. Exploration of the proposed "DOGE dividend" stimulus checks and the feasibility of funding them through federal spending cuts.