White Paper Series Title: "Reviving America: A Supply-Side Blueprint for Economic Freedom"

Part 2:

Reaganomics: The Supply-Side Revolution That Rescued America from Stagnation

Author: the Conservative TAKE contributor

Date: April 10, 2025

Prepared for: Constitutional Conservatives, Supply-Side Advocates, and American Patriots

Executive Summary

The 1980s were a turning point in American economic history. After a decade of Keynesian chaos, runaway inflation, and stagnation under Presidents Nixon, Ford, and Carter, Ronald Reagan brought a bold, unapologetic return to supply-side economics. Through massive tax cuts, deregulation, sound money, and restoring business confidence, Reagan ignited one of the greatest economic expansions in U.S. history.

This paper analyzes how Reagan reversed the exact same mistakes made by Hoover, FDR, and other central planners during the Great Depression—and how his policies vindicated the free market, disproved Keynesian myths, and laid the groundwork for long-term prosperity.

I. The Economic Crisis Reagan Inherited

When Reagan took office in January 1981, America was in a deep crisis:

Inflation: Over 13%

Unemployment: 7.5% and rising

Interest rates: Over 18%

Growth: Negative GDP in 1980–82

Morale: National despair, declining productivity, and a “malaise” economy

This was stagflation—a toxic mix of inflation and stagnation that Keynesian models said was impossible. But it was real, and it was devastating.

II. Reagan’s Supply-Side Strategy

Reagan knew the answer wasn’t more government—it was unleashing the private sector. Guided by classical economists like Milton Friedman, Arthur Laffer, Jude Wanniski, and Jack Kemp, Reagan implemented a four-part strategy.

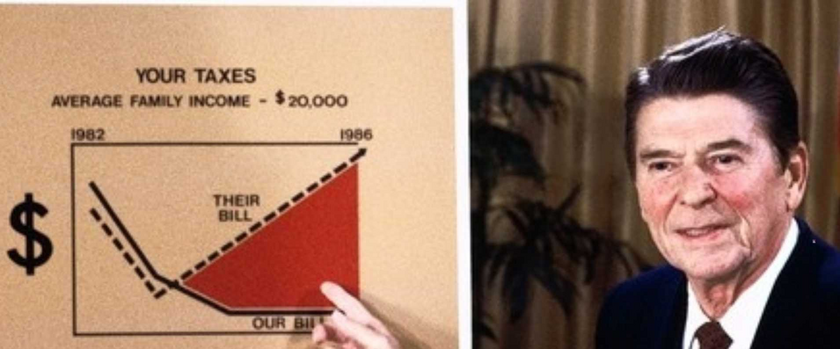

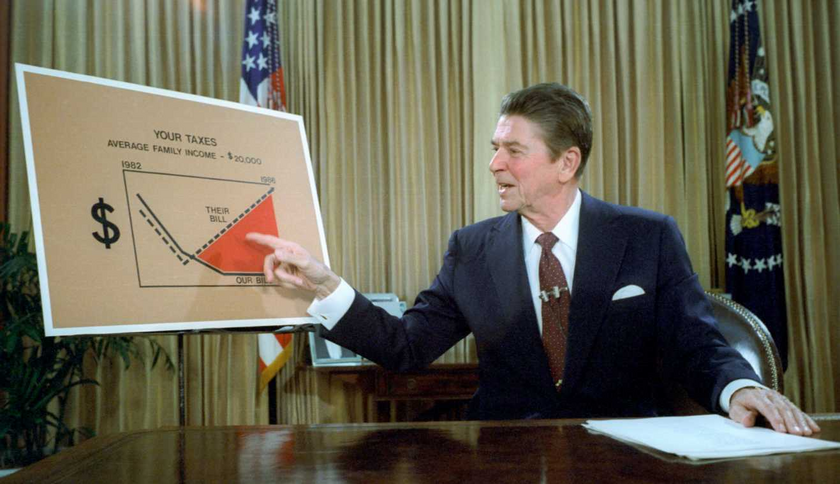

A. Major Tax Cuts: Incentivizing Work, Saving, and Investment

Economic Recovery Tax Act of 1981 (ERTA)

Cut top individual tax rate from 70% to 50%

Across-the-board income tax cuts of 25% over three years

Introduced Accelerated Cost Recovery System (ACRS) to promote capital investment

Indexed tax brackets to inflation (ending “bracket creep”)

Results:

Private investment surged

Job creation exploded

Revenues eventually increased, despite lower rates (Laffer Curve in action)

Contrast with FDR: While Roosevelt raised taxes on businesses and individuals, Reagan cut taxes to unleash the supply side of the economy.

B. Monetary Discipline: Fighting Inflation Without Killing Growth

While Reagan’s team handled fiscal policy, Federal Reserve Chairman Paul Volcker, supported by Reagan, slammed the brakes on inflation with tight monetary policy.

High interest rates were painful (recession in 1981–82), but short-lived

Inflation dropped from 13.5% in 1980 to 3.2% by 1983

Reagan stood firm and let the market adjust

Contrast with the 1930s Fed: Instead of shrinking the money supply like the Great Depression era, Reagan supported tight but rational monetary policy—short-term pain, long-term gain.

C. Deregulation: Restoring Free Market Competition

Reagan slashed regulations that stifled industry:

Airlines, trucking, energy, and telecommunications were freed from decades of red tape

Reduced the top marginal capital gains tax

Ended price controls and wage controls from the Nixon-Carter era

Impact:

Lower costs

More innovation

Greater productivity and competition

Contrast with the New Deal: Reagan dismantled the bureaucratic grip on the economy, while FDR expanded it through agencies like the NRA, AAA, and SEC.

D. Rebuilding Business Confidence

Reagan knew that entrepreneurs are the engine of the economy. His policies and rhetoric signaled clearly: America was open for business again.

No more demonizing “the rich” or “profits”

Emphasized private enterprise, family values, and self-reliance

Reagan restored economic optimism, and confidence fueled growth

Contrast with Hoover/FDR: Reagan didn’t create “make-work” jobs—he freed the market so real jobs could flourish.

III. Economic Results of Reaganomics

The results were undeniable—and historically unmatched:

| Metric | Before Reagan (1970s) | After Reagan (1983–1989) |

|---|---|---|

| GDP Growth | Avg. 2.2% | Avg. 4.6% |

| Inflation | Avg. 11% | Avg. 3.5% |

| Job Creation | - | 20 million new jobs |

| Stock Market | Flat decade | Tripled in value |

| Tax Revenue | Falling with high rates | Increased with low rates |

And let’s not forget: Reagan rebuilt the military, defeated communism, and restored American pride. His economic success laid the foundation for the tech boom of the 1990s, driven by the investment climate he created.

IV. Addressing Keynesian and Leftist Critiques

Claim: Reagan created deficits.

Truth: Congress kept spending. Reagan cut tax rates, but revenues rose. The problem was spending, not tax cuts.

Claim: Reaganomics helped only the rich.

Truth: Middle-class incomes rose, inflation fell, and unemployment dropped. Wealth creation helped everyone—especially those who work.

Claim: Trickle-down doesn’t work.

Truth: It's not “trickle-down”, it's supply-side. When you let producers produce, the whole economy grows.

V. In the end... A Blueprint for Revival

Reagan didn’t guess. He learned from the past. He looked at what failed in the 1930s—high taxes, big government, central planning—and did the opposite.

He proved:

Freedom works

Lower taxes = higher growth

Stable money = sound economy

Deregulation = innovation

Confidence in capitalism = jobs and prosperity

The legacy of Reaganomics is clear: when America returns to limited government and economic liberty, it thrives.

Key Sources

Friedman, Milton. Free to Choose (1980)

Laffer, Arthur. The End of Prosperity (2008)

Reagan, Ronald. An American Life (1990)

Wanniski, Jude. The Way the World Works (1978)

Gilder, George. Wealth and Poverty (1981)

Stockman, David. The Triumph of Politics (1986)

Moore, Stephen and Laffer, Arthur. Return to Prosperity (2010)

U.S. Bureau of Economic Analysis, Historical Tables

Heritage Foundation Economic Policy Archives

Cato Institute, “Reaganomics at 40” symposium (2021)

Tomorrow, we conclude with Part 3 which reveals how Trump used tariffs strategically, calmed markets, and turned the world against China, fueling a market surge and reaffirming America's dominance in global trade. Title: Trump’s America First Economy: Beating China and Boosting Markets